let's "enrich the entrepreneurs" instead of "enriching the rich"

|

Scrolling through the 'gram the other day, this clip from @KamalaHQ (her rapid response social media channel) highlighted Mark Cuban's conviction that Harris' economic policies are better for investors and entrepreneurs than Trump's plan. Goldman Sachs agrees. kamalahq

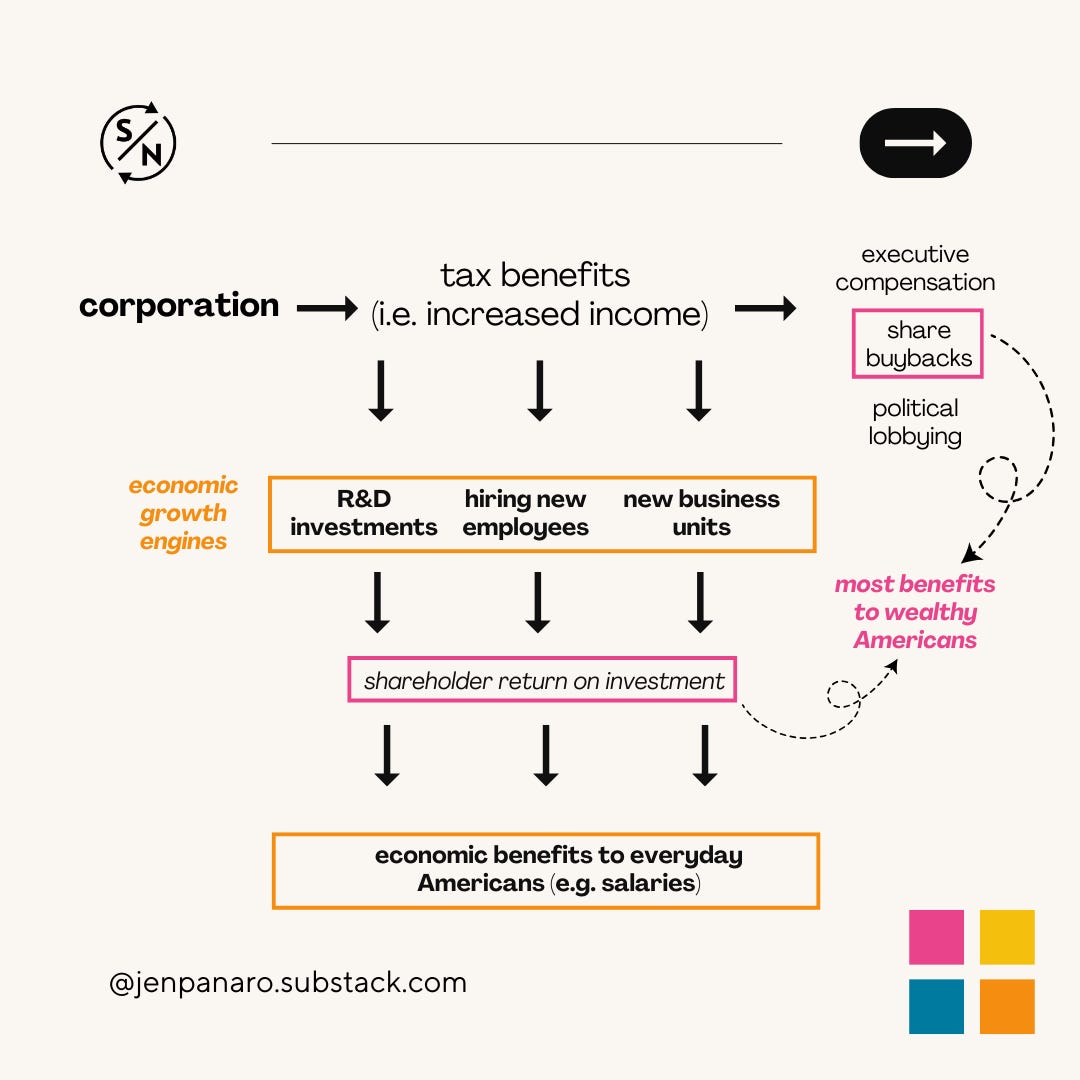

A post shared by @kamalahq I appreciated his informed input, but something Cuban said in passing struck me. He said: "The higher the capital gains tax, the more difficult it is to invest in riskier investments. And the people who have the hardest time getting risk capital are women, people of color, young kids that are coming out of college, the people you want to take risks on. The higher the capital gains rate, the harder it is to invest in them for obvious reasons." What? 🫤 What "obvious reasons"? Maybe young people face more challenges getting capital because they have less work and real-world experience. But women and people of color? Are we just accepting a blanket status quo that women and people of color have a harder time getting capital because their gender or skin color makes them riskier regardless of consideration of the business idea, experience, industry, etc...?! investors believe women and POC are riskier founders?Alright, friends, he said the quiet part out loud. The private investment industry is biased based on race and gender. This is not news; we have lots of data to back this up, and it's not outside our cultural norms. I'm not suggesting that Cuban or the host are sexist or racist; I have no idea. I really like Mark Cuban (as much as I know about his public persona). They’re both just stating the facts of the industry. According to research from consulting firm McKinsey, "In 2022, Black and Latino founders received only 1 percent and 1.5 percent, respectively, of total US venture capital (VC) funding. Women-founded teams received 1.9 percent of VC funds, and only 0.1 percent of VC funds went to Black and Latino women founders." These numbers do not align with the representation of these demographic groups in the general population. so the theory goes… Startups run by women and people of color are perceived to be riskier by the mostly white men who decide how to invest venture capital and private equity dollars. Investors want higher anticipated returns when taking on higher risk (high risk, high return). Reducing capital gains taxes increases the real return to investors of any given investment outcome. Thus, the theory goes that lower capital gains taxes increase the real return on investment and open doors for greater risk tolerance (i.e., investing in women and people of color). Let's examine why this seemingly throwaway comment matters regarding economic policy plans in at least a couple of ways. that bias is not accurateThis comment is telling about the -isms that plague the private investment industry, particularly because women and people of color often drive innovation and economic gain by creating companies unique to their demographics and in untapped markets. Women and people of color unlock specific investment opportunities that most white men can’t access or ignore because no one understands particular market segments better than those participating in said markets. Furthermore, McKinsey's research states, "Beyond the larger macroeconomic gains, founders with greater gender and ethnic diversity achieve 30 percent higher returns for investors upon exit than their white men founder counterparts." It sounds like investors don't actually need lower capital gains taxes to earn higher returns on start-ups founded by people other than white men. why this should inform economic policyThe racial and gender bias rampant in the private investment industry should be one piece of data that informs how tax policies incentivize investment in new business creation. Trump favors a "top-down" approach, while Harris favors an approach that includes more "bottom-up" opportunities. I wrote previously about how the "top-down" or "trickle-down" economic policy that's been popular in the United States since the 1980s does not work for most Americans. Economic growth has disproportionately benefitted wealthy Americans and increased income inequality dramatically in the last forty years. So long as the more affluent people who are receiving the benefits at the top siphon off even a little bit "extra" for themselves, income inequality will continue to increase over time. Cuban’s comments highlight another layer of inequity to this top-down approach. Private investors using government tax handouts like low capital gains taxes to propel new investments mostly favor white men over all other demographic categories. The government should not be relying so heavily on fueling economic growth through an engine that has demonstrated for decades its consistently racist and sexist approach to investment selection. corporate tax cuts disproportionately benefit executives and investorsTrickle-down or top-down economic growth schemes include giving tax incentives to corporations in the form of lower tax rates, tax credits, special deductions, etc. These tax incentives increase the corporation's real income for any given measure of business success and operations. A lot of that income is siphoned off to those already at an advantage before it filters into the hands of everyday Americans and rebuilds the dwindling middle class.

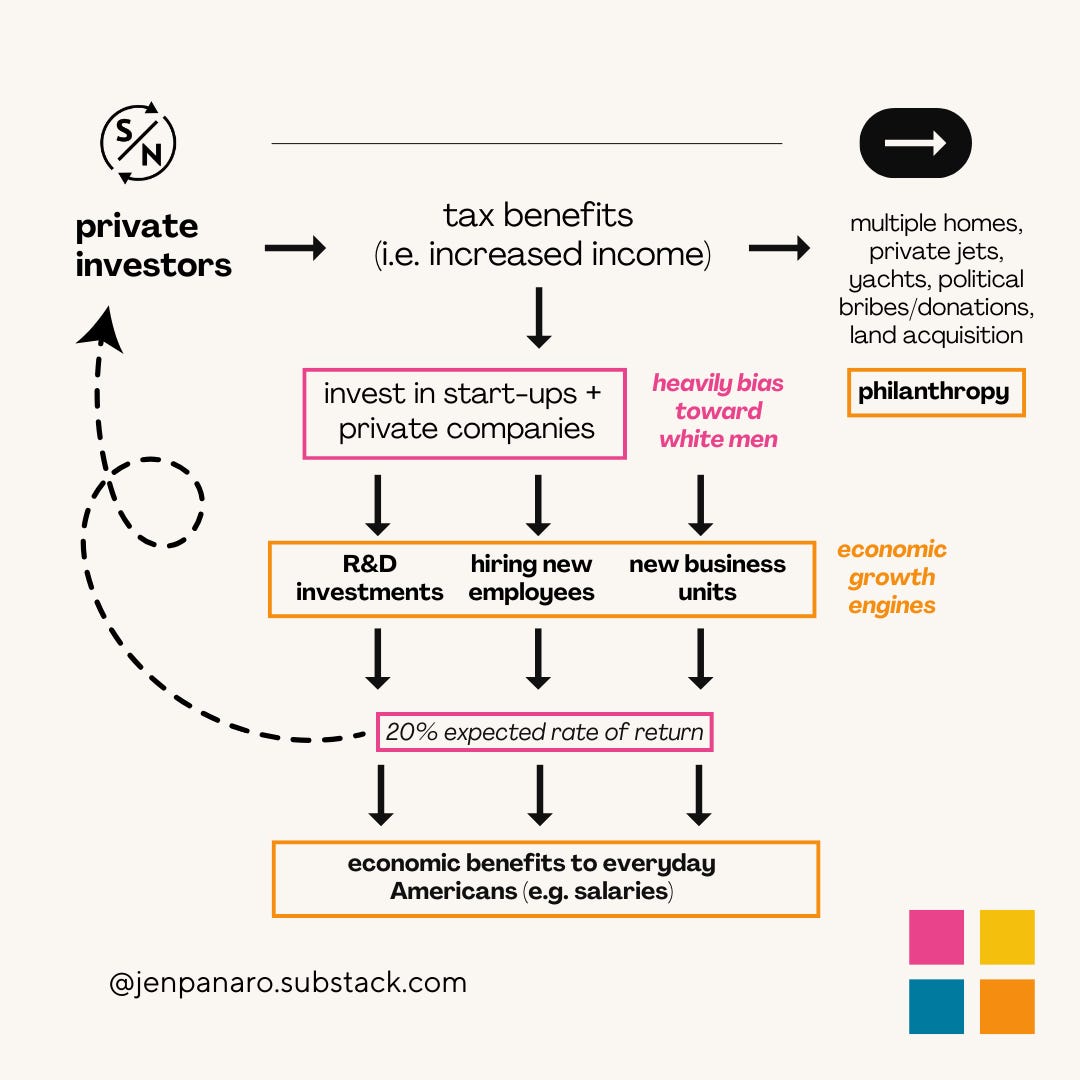

executive compensation Large portions of the benefits designed to generate economic growth from the top (corporations and wealthy individuals) get stuck at the top and exacerbate income inequality. Corporate leaders increase their own compensation at greater rates than employee compensation. A study from the Economic Policy Institute, an independent, nonprofit think tank that researches the impact of economic trends and policies on working people in the United States, found that "from 1978–2022, top CEO compensation shot up 1,209.2% compared with a 15.3% increase in a typical worker’s compensation." And "In 2022, CEOs were paid 344 times as much as a typical worker in contrast to 1965 when they were paid 21 times as much as a typical worker." corporate share buybacks Many corporations use excess profits, which can result from favorable tax benefits, to buy back stock from the public market. According to the Federal Reserve and as reported by USA Facts, nearly all investments in stocks and mutual funds are owned by the top 20% of Americans. In other words, share repurchases turn government tax incentive handouts into income mostly for the top 20% of Americans. lobbying Excess profits from tax incentives also allow companies to increase their budgets for lobbying - directly and through trade associations and other influential organizations of which they are members. According to OpenSecrets, a nonpartisan, independent nonprofit research group tracking money in U.S. politics and its effect on elections and public policy, organizations spent $4.2 billion lobbying government officials in 2023. Lobbying can be well-intentioned or malicious in nature, but most of it paid by corporations (directly or indirectly) ultimately seeks to support the entity's profit motives and funnel more cash back into its coffers. lower tax rates for wealthy individuals (i.e. private investors)Top-down economic growth schemes also promote lower tax rates for individuals already making the most money, assuming that these individuals will invest the tax benefits (in the form of increased real income) in start-ups, small businesses, and other ventures. However, this only exacerbates the concentration of wealth at the top through personal asset accumulation, bias in investment selection, and outsized returns to investors before passing along economic benefits to everyday Americans.

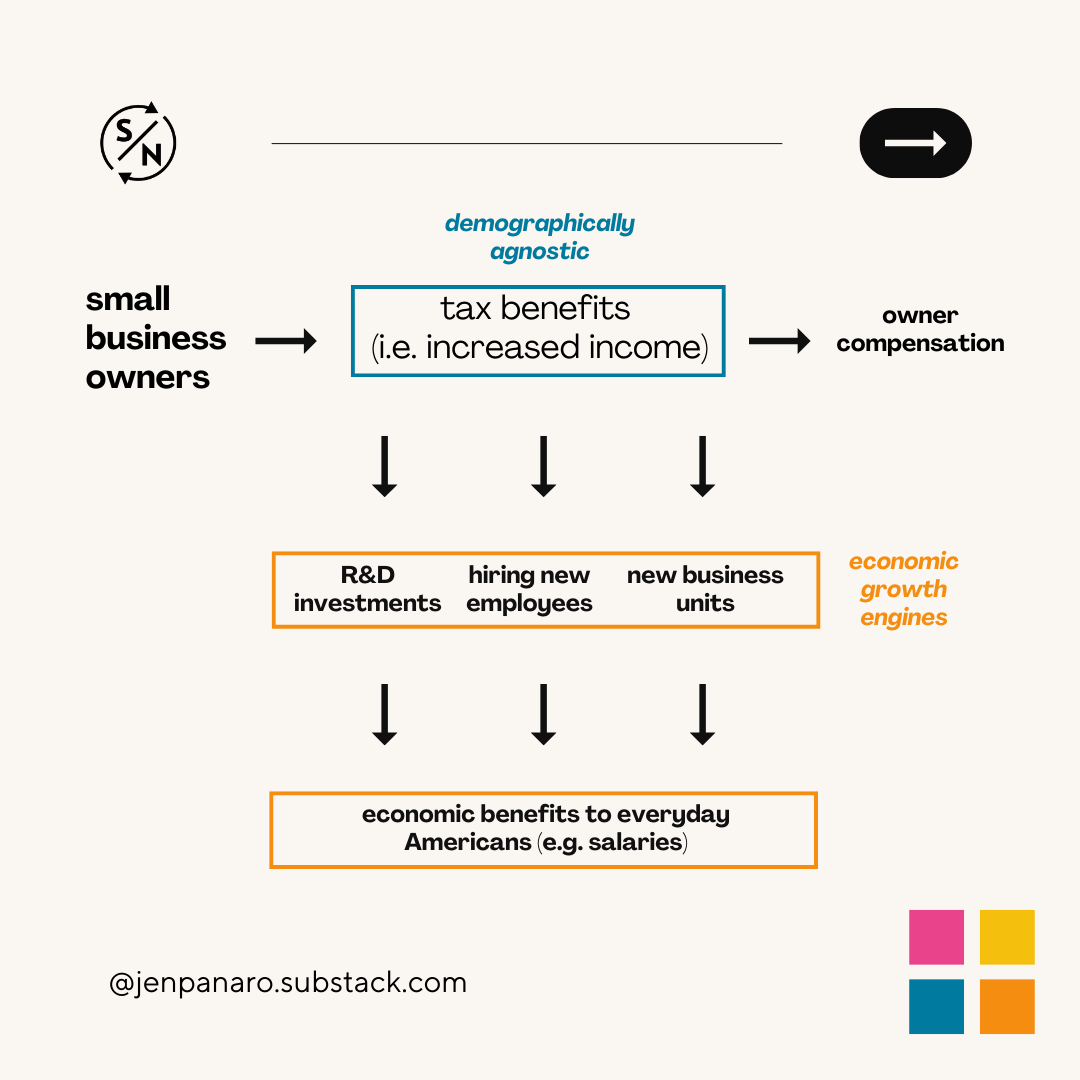

personal asset accumulation Like corporations, before any excess income is invested in start-ups or private companies, wealthy individuals spend money on multiple homes, private jets, yachts for their yachts (yes, it’s a thing), political bribes and donations, land acquisitions, and philanthropy. Homes, jets, and yachts do nothing for everyday Americans. Shocking, I know. Political bribes and donations are heavily in favor of Republicans, which makes sense because many Republican tax policies favor those who don't want to share their excessive wealth. OpenSecrets disclosed that of the top 100 individual donors to the 2024 federal election, $255M of contributions come from "Solidly Democrat/Liberal" while $693M of contributions come from "Solidly Republican/Conservative". I don't think they need any more tax breaks. Some land acquisitions are conserved, which benefits everyone qualitatively but also secures many rights and privileges by having so much control over a precious resource. Of course, philanthropy is a noble cause that has its critics. There's reasonable debate over whether funding for social benefits is best directed through market means like private philanthropy or public avenues like taxes. bias to invest in white men As I initially noted, private investors heavily favor investing in white men. They invest more frequently and in larger amounts in start-up ventures run by white men. These biased investment selections reinforce income inequality among demographic groups. expected outsized return to investors After the impacts of the tax incentives have been used to accumulate personal assets, invest disproportionately in white men, and support business operations, the private investment market expects a 20%+ return on the investment. This return, that goes back to wealthy private investors who can invest in private equity and venture capital funds, isn't directly "skimmed off the top" before any salaries or vendors are paid. However, when building forecasts for anticipated profit margins of the investment companies, the rate of return expectation intersects with the modeling. It informs how much capital investors see as available to pass along to the "bottom" of the economic scheme. These graphics are oversimplified and not perfect. But they offer a visual to reinforce that when tax incentives are accrued at the top in order to generate economic growth from the wealthy and hope it trickles down to everyone else (it mostly doesn’t), those in control of the capital skim benefits off the top for themselves at several points along the way and leave far less than a fair share for everyone else. Hence, income inequality has skyrocketed since the 1980s when these ideas came into high fashion. alternatively, tax benefits to small businessesWe've seen a recent revival of popularity for tax incentives targeted at the bottom to work their way up through the economy and create growth in the other direction. In this case, the government gives tax benefits directly to small business and middle class individuals. These benefits have less implicit bias (they're typically issued regardless of racial and gender demographics) and offer more significant direct benefits to those who need them most - the lower and middle class in the United States.

trump v harris on these policiesThe biases and practices associated with different avenues of economic growth stimulus highlight a core contrast between the Trump and Harris policies. Trump wants to give government handouts—in the form of tax benefits—to the wealthy and let them decide who they will invest in (proportionately fewer women and POC, apparently because they are "riskier"), how to invest, and how to distribute those benefits. On the other hand, Harris prefers to give more people who want to start small businesses direct benefits like larger deductions for start-up expenses and more access to small business planning resources without increasing tax rates for smaller companies. This would make it easier for anyone to start a small business whether or not the elusive “Investor Gods” choose them. Everyone deserves a fair chance, not just the people who have access to and make it through the gauntlet of investor coffee chats and presentation decks to woo the whims of the rich. This intersection of top-down versus bottom-up tax benefits and inequity in the private investment space highlights why Harris' strategies are more equitable from two perspectives. direct decision making First, it puts the power to decide how tax benefits are used in the hands of those who want to use them (small business owners), not just the mostly white men at the top of our socioeconomic structure who already have disproportionate amounts of wealth, power, and influence. Corporations and private investors do not share the benefits equally (because who would?), but the evidence is clear that the top-down investments heavily favor white men. We don't need more upper-class white men with more money controlling more purse strings; we need precisely the opposite! access to businesses of all sizes Second, bottom-up economic growth incentives benefit businesses of all sizes, not just startups with significant cash needs and massive potential returns (i.e., targets of wealthy private investors). Lots of people start businesses with the intent to keep them locally owned and small; they enjoy the work of running them to make a living without making a fortune. These businesses are much better for local community building, too, but that's a discussion for another day. On the other hand, investors expect an estimated 20% return within five years and must invest large sums of money to make investing worthwhile. Most small businesses don't need the level of capital investment or seek rates of return sufficient to warrant the attention or funding from large investors. Your neighbor doesn't need hyperbolic growth and to sell their business for a 20% return on investment to be considered a success. They want to use company profits to pay their mortgage and grocery bills for the foreseeable future. more to "best economic policy" than total growthMeasuring economic prosperity and growth opportunities for everyday Americans is more than the top-line statistics that catch attention in the media. It matters to whom those benefits accrue. When we allocate substantially all government handouts that incentivize economic growth (like tax incentives) to those at the top, they disproportionately benefit those who already have plenty, as shown in the graphics above. Harris' Opportunity Economy plans offer a more significant share of the economic benefits directly to the middle class and those seeking to pursue the American Dream of getting ahead and building a better life for the family. Trump's plan, on the other hand, reinforces the economic policies of the last several decades that have drastically and unfairly increased income inequality, leaving most Americans feeling like things are getting worse while the big picture appears to get better. we need lots of paths to investmentI’m not suggesting we entirely forego private investment markets from wealthy investors (that’s a silly proposition). Many industries and businesses require substantial, long-term capital investments, and venture capital fits this need. Climate change innovations, like renewable energy advancements, are a great example of this. We should continue working to ensure the private investment market is fair. We need a more diverse group of decision-makers investing in a broader group of founders. Mega millionaires and billionaires should be paying their fair share of taxes (they currently are not). Harris' plan provides a more expansive and equitable variety of avenues to fuel economic prosperity and revitalize the middle class by shifting government handouts that drive economic growth to a broader group of people through access to bottom-up tax incentives. Economic prosperity is more complex than overall indicators and GDP growth. It's relative to your neighbors. It matters how benefits are distributed. Bottom-up growth incentives provide more direct prosperity opportunities to those needing them most and with far less racial and gender bias. Let's chart a New Way Forward. -- Jen Panaro |

Sage Neighbor | On Building Community

For nearly a decade, I’ve been writing about how we can live more sustainable, eco-friendly lives, especially with kids. Through increasingly divisive battles about the “right” ways to move forward, we always come back to strong and resilient communities propelled by conversation, collective action, grace, and cooperation. I’d love for you to subscribe to the newsletter and join a thoughtful conversation on climate action and building community through connection and civic engagement as sage neighbors.

Back in 2012 (maybe 2013?), I dreamed of getting a Tesla! I was an auditor for a large public accounting firm serving private equity and venture capital funds. I remember sitting in a VC fund client’s office in Palo Alto, California (the heart of Silicon Valley), where he told me about buying one of the first Tesla Model S cars just a few weeks earlier. I was young and had nowhere near enough money to buy one, but I told him I’d love to have one someday. In 2021, I finally drove that Tesla...

Last fall, I'd had enough. 🤬 It started long before the fall, but that was the tipping point (though my frustration continues). I am fed up with the misinformation and disinformation. I have seen enough of flooding the zone with sh*t at the national level that fills (and poisons) the void of limited to no local media in our communities. I am sick of the increasingly repugnant, divisive vitriol and hatred. I loathe that political partisanship waits in the wings of any casual conversation,...

Enough is enough. Or shall I say, enough is enough is enough is enough. What are we doing??! Where are we headed? 😵💫 The world is changing (some might say collapsing). The climate - political, environmental, and community - is scorched. Someone needs to put out the fire. Why not you and me? 🫵🏻 This is the renewed focus of Sage Neighbor. it’s falling apart Things we once took for granted no longer seem reliable. Safe homes in a predictable climate. Democracy. (Mostly) equal rights for women....